Tristan /

The Bitcoin Halving will be reorged

Every four years (or every 210,000 blocks to be precise) Bitcoin’s issuance per block gets cut in half. So far, we’ve never really placed much importance on who actually mines the block that triggers the next halving cycle, we just have a short moment of celebration and then move on.

But this year’s Bitcoin halving is not like other halvings. Block 840,000 will likely have the most valuable block reward in Bitcoin’s history by far.

This is all because of one man—Casey Rodamor, the creator or the Ordinals protocol. He has almost single-handedly created the biggest MEV opportunity ever in Bitcoin, and it will be impossible for miners to resist.

To see this more clearly, let’s do a quick analysis to estimate what the value of block 840,000 is.

The Epic Sat

At the core of Casey’s Ordinal theory is the concept of assigning serial numbers to individual satoshis and tracking them over time.

Once satoshis become non-fungible, it naturally follows that some sats will be considered more valuable than others, maybe because its number is aesthetically pleasing, or because it was involved in a transaction of historic importance.

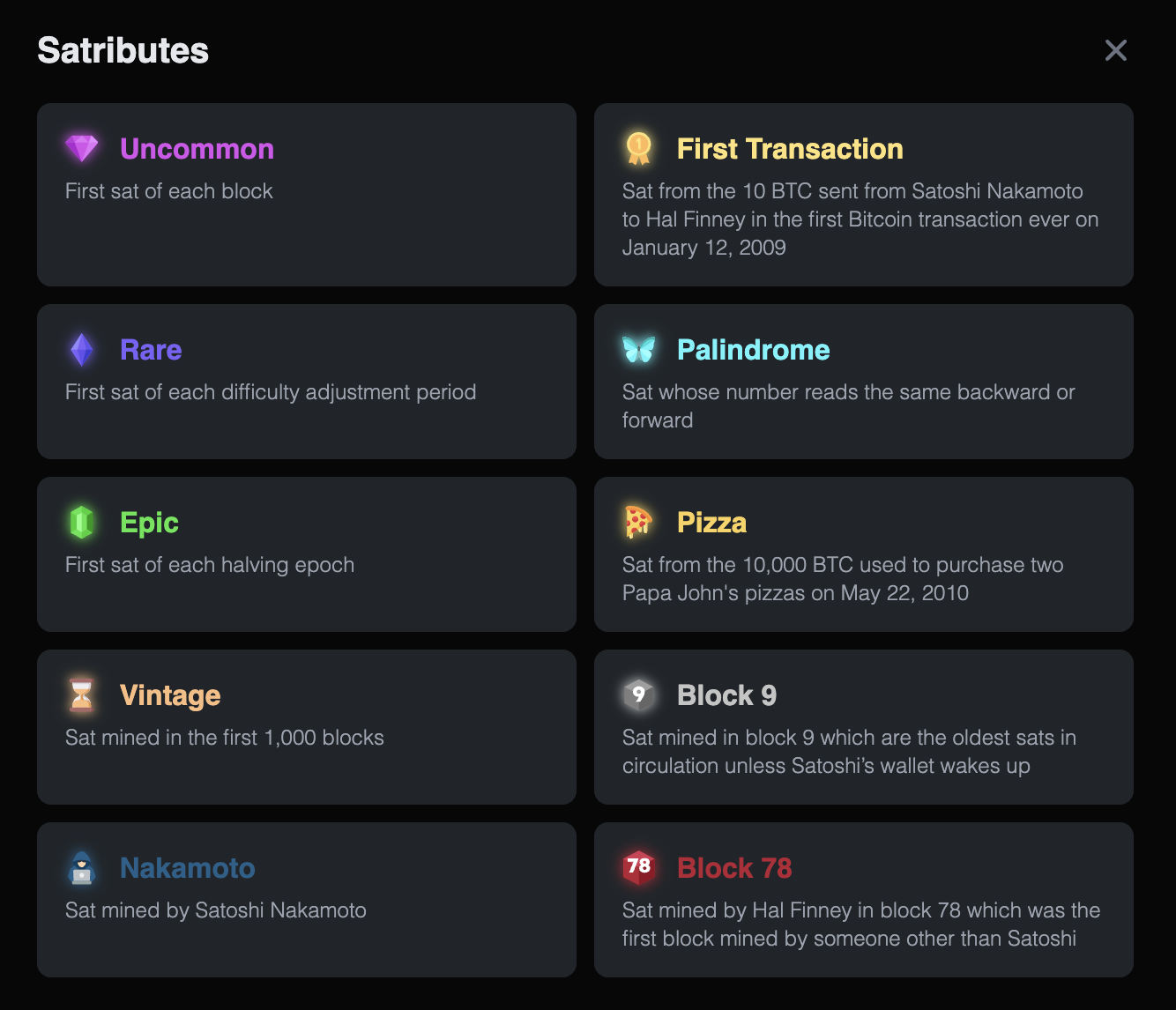

A list of popular traits (or “satributes”) that an individual satoshi can have. From ord.io

A list of popular traits (or “satributes”) that an individual satoshi can have. From ord.io

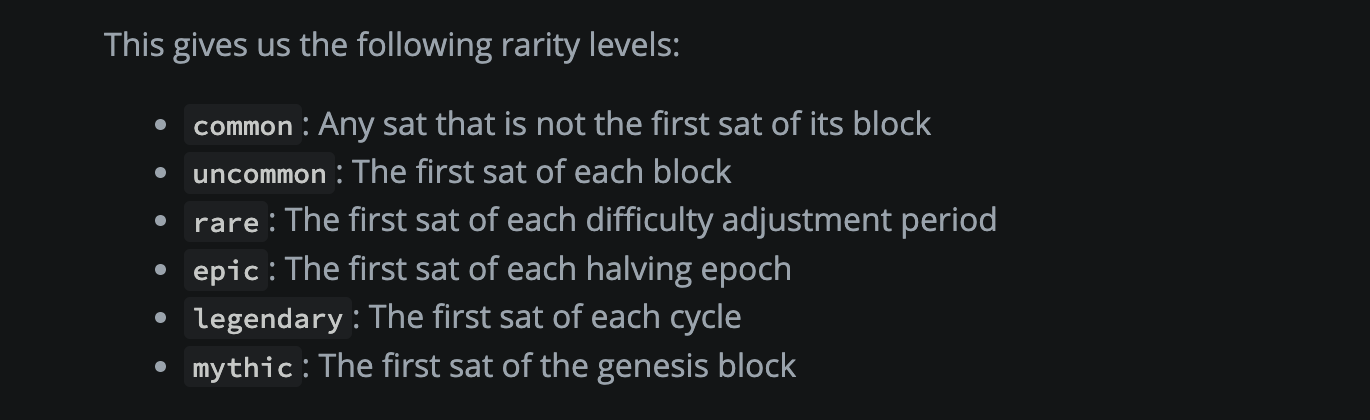

One of the most popular ways of categorising sats today is using the Rodarmor Rarity system, which tracks the events triggered by Bitcoin’s protocol rules (i.e. new blocks, new difficulty adjustment periods, new halving periods) and assigns extra importance to the first sat that gets created in each one.

The different levels of sat rarity, according to Casey Rodarmor

The different levels of sat rarity, according to Casey Rodarmor

While some consider this way of viewing sats nothing more than a frivolous hallucination, it’s impossible to deny that it has found its niche within a community of Bitcoin collectors and archeologists.

The floor price of a single Uncommon sat on MagicEden is currently $400 (0.01 BTC), and Sotheby’s recently sold a Rare sat for over $100,000 (2.71 BTC)!

And yet, none of these previously sold sats will be nearly as valuable as the sat that is set to be mined in block 840,000 – the Epic sat.

An Epic sat is created once every halving, so the total supply currently stands at just 3! As none have been sold yet, their market value is still a mystery. However, knowing that Rare sats are selling for $100k a pop, and that the supply of those is 100 times bigger than Epic sats (410 vs 3), we can safely say that the Epic sat will probably be valued at least 10 times higher than a Rare sat. That puts its price at around 1 million dollars (or roughly 25 BTC at the time of writing).

Note that this price is what you could reasonably ask for if you decided to just sell it straight away. The smarter move would probably be to keep the sat and capitalise on the range of opportunities that it opens up, potentially generating a large income stream for years to come. As the number of inscriptions keeps increasing, the simplest and most obvious way to stand out from the noise is to inscribe your collection on a special sat.

The inscriptions in the Pizza Ninjas collection were all inscribed on “Pizza sats”, i.e. sats that were involved in the infamous 2010 Pizza transaction. The first inscription is on an Uncommon Pizza sat. The collection has a market cap of ~100 BTC.

The inscriptions in the Pizza Ninjas collection were all inscribed on “Pizza sats”, i.e. sats that were involved in the infamous 2010 Pizza transaction. The first inscription is on an Uncommon Pizza sat. The collection has a market cap of ~100 BTC.

Remember – not a single inscription has been made on an Epic sat yet. Whoever makes the first one could easily create a whole collection with that inscription as its parent in order for every piece to accrue value.

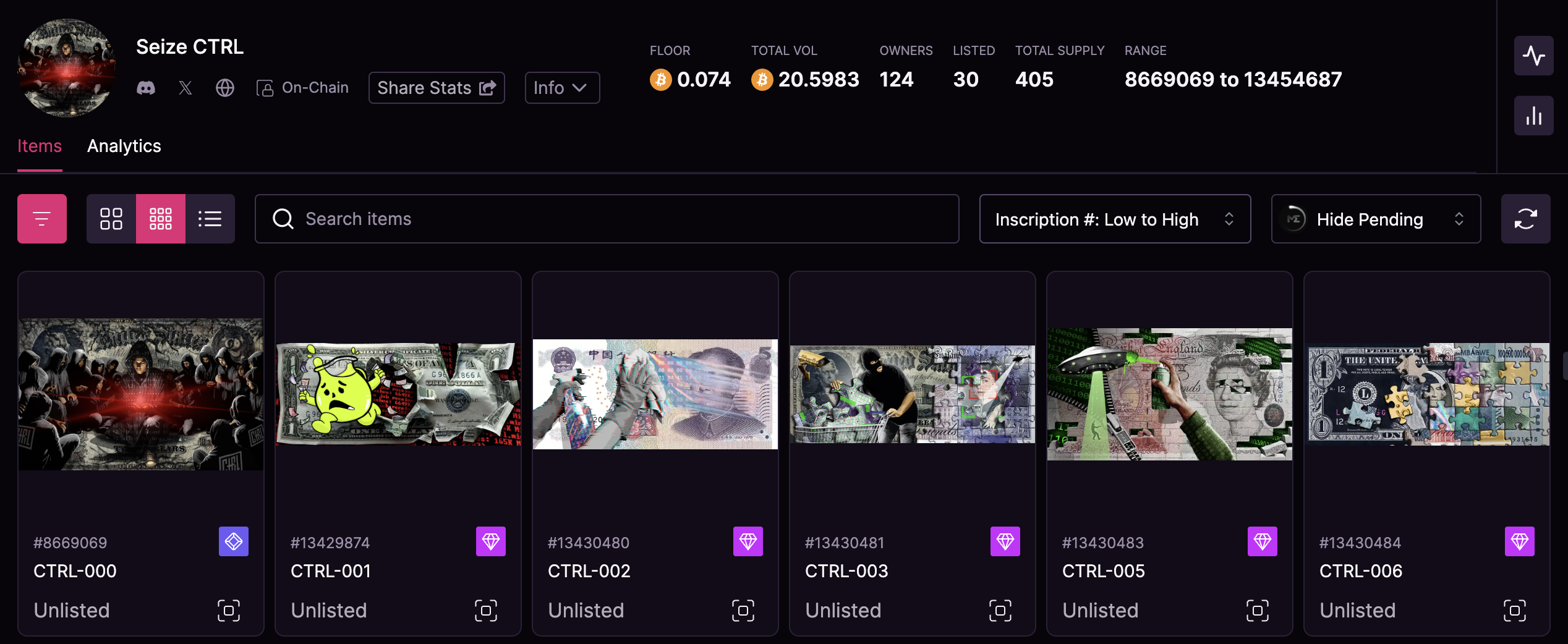

“Seize Ctrl” made the first ever inscription on a Rare sat, and then turned it into a collection of 405 pieces. The collection now has a market cap of ~30 BTC.

“Seize Ctrl” made the first ever inscription on a Rare sat, and then turned it into a collection of 405 pieces. The collection now has a market cap of ~30 BTC.

Estimated value of Epic sat in the Halving block: $1M+ (25 BTC)

So the existence of the Epic sat already makes this block extremely valuable. However, it pales in comparison to the next thing that block 840,000 will also contain.

The First Rune Token

The Runes protocol is a new token standard by Casey Rodamor that’s set to launch as soon as block 840,000 kicks in. As one would expect, we’ve already started to see multiple teams on X market their upcoming token as “The First Rune”.

The truth of course is that we won’t know for sure who gets to claim that title until the block is actually mined. But why is being first even important?

We can look at the BRC-20 ecosystem for a clue. The first ever BRC-20 token, ORDI, was created by domo in March 2023. The token has no utility or special attributes other than being the first of its kind, and yet it is still the most valuable BRC-20 token today, with a market cap of over 1 billion dollars.

Top BRC-20 tokens by market cap. From coingecko.com

Top BRC-20 tokens by market cap. From coingecko.com

By pretty much any standard, Runes is a much better designed protocol for fungible tokens than BRC-20 is, with longer potential staying power. A cautious projection suggests that the first Rune token, even if it has a ridiculous name and no utility whatsoever, will quickly amass a market cap of $1B+.

One very important difference between Runes and BRC-20 is that Runes don’t necessarily have to have a fair launch where the initial supply is zero and anyone can mint them. Teams that launch a Rune token have the ability to allocate (i.e. premine) it to themselves in the etching transaction.

This by itself makes it insanely attractive to be the team that launches the first Rune token. We don’t know what the premined team allocation for that first token will be (maybe there won’t even be one!), but it would seem like a huge wasted opportunity not to allocate at least a little bit to the creators, in order to secure their financial future forever.

In the world of smart contract platforms like Ethereum and Solana, it’s very common for the founders’ token allocation to be around 25% of the total supply. Again, let’s be extremely conservative and estimate that only 5% of the first Rune token’s supply is allocated to the team. At a 1 billion dollar valuation, that would still leave its value at a whopping 50 million dollars!

Estimated value of team allocation of first Rune token: $50M

So what will happen?

By conservative estimates, the data in block 840,000 is easily worth at least $50M dollars (or well over 1000 BTC). This is more than 200 times higher than the standard block reward, which at the time of writing is averaging ~6.5 BTC. In other words, block 840,000 is worth at least 2 orders of magnitude more than any other block before it.

This has never happened before, and dangling that huge money pot in front of miners will make it extremely hard for them to play by the usual rules. So what can we reasonably expect to happen in April this year?

Well, we know that mining pools like AntPool, SECPool and F2Pool have already started experimenting with Ordinal MEV by extracting rare sats from the blocks they mine.

AntPool extracting a Rare sat. Source: mempool.space

AntPool extracting a Rare sat. Source: mempool.space

Similarly, the mining company Luxor made headlines last year by skipping the mempool and filling a whole block with a single inscription of a 4MB Taproot Wizard JPEG. Other pools like Terra Pool have since followed and turned the process of inscribing large files into a service they offer.

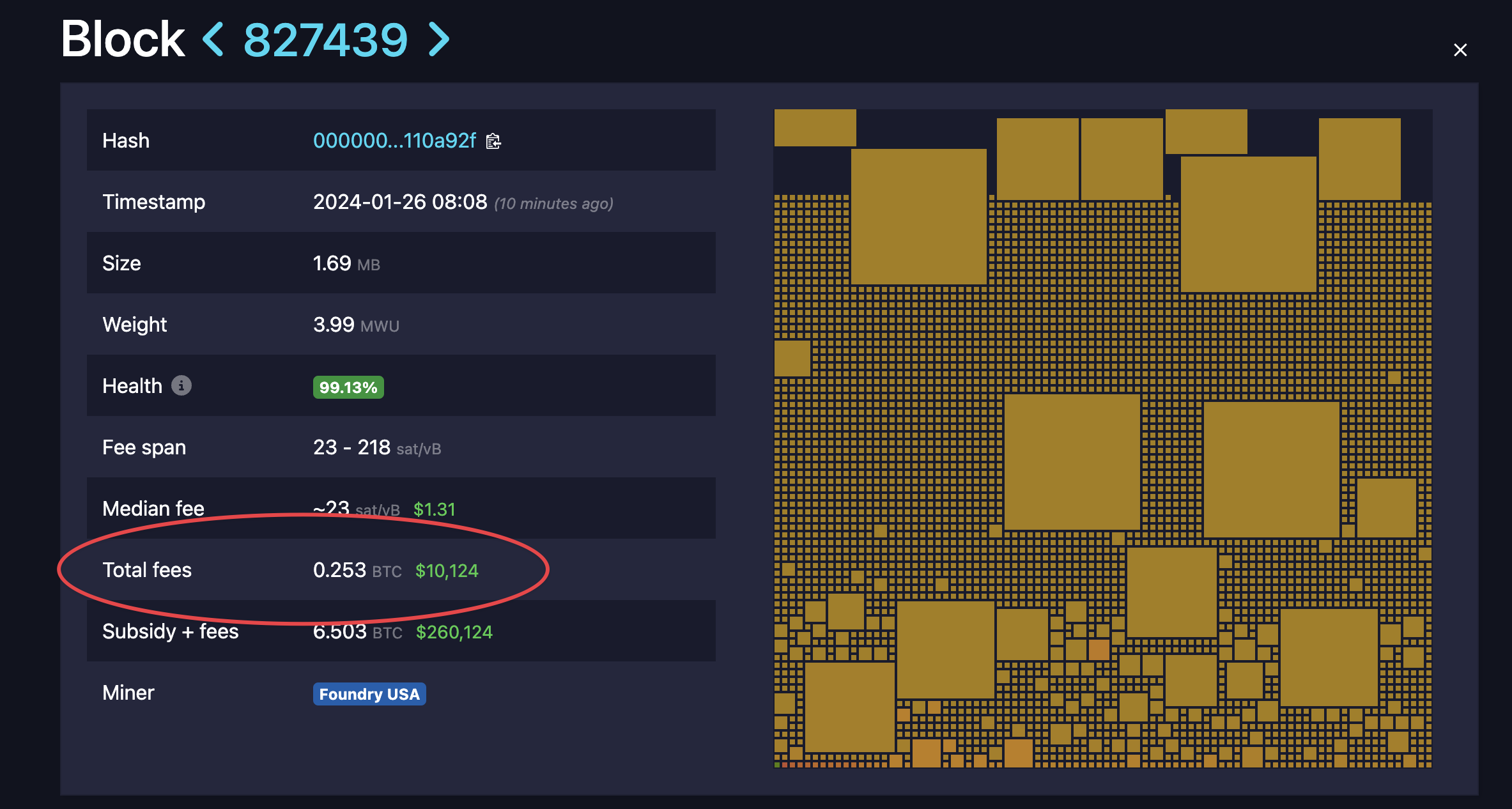

When you think about it, the cost to privately buy a block from a miner is really just the cost to cover the sum of transaction fees that they’re missing out on, plus a small premium. Those transaction fees currently average around ~$10,000, which really isn’t much at all.

The result is inevitable: block 840,000 will almost certainly not be a “normal” block where a miner just snaps up the highest paying transactions from the mempool. The prospect of a collaboration between a capital-rich team in the Ordinals space and a mining pool presents an overwhelmingly attractive opportunity. In fact, it would be foolish for the miner to leave that money on the table!

Consider a hypothetical situation where a project proposes to pay a miner 5 million dollars for the exclusive right to design a block:

- The miner gets 500 times their usual fee income with virtually no extra effort.

- Since the content of the block is arguably worth $50M+, the team that bribed them can easily capitalise on both the Rune and the Epic sat to earn at least 10 times the $5M that they spent, probably also with relatively little effort.

Given this situation, the biggest mining pools are likely being approached as we speak with very lucrative deals in preparation for the halving.

But what happens if two independent Ordinal teams strike deals with competing miners? This is the scenario where we’ll potentially see the mother of all reorgs.

If the miner is paid $5M to mine the halving block, and the next few blocks only have rewards of ~$125,000 each, they should theoretically be okay with missing out on the revenue of ~40 blocks. In other words, even if one miner gets there first, and their version of block 840,000 already has multiple confirmations, there will still be strong incentives for another miner to keep placing their bet on building on top of their version of block 840,000 instead. There is always that small chance that they find multiple blocks in a row and win the race.

So it seems almost inevitable to me that we’ll see the mother of all reorgs on Bitcoin this year. While I don’t know exactly how it will play out, one thing we know is that it will certainly be interesting, and eventually the dust will settle and new blocks will keep coming in as normal.

It also makes it clearer than ever why Bitcoin’s transaction fees need to go up over time. It’s currently too cheap for private parties to come in and bribe the operators of mining pools. If an NFT or token company can make miners dismiss a bunch of transaction in their favour, you can be sure that a state actor could do the same. The number of high-fee transactions in the mempool needs to go up to become more attractive to miners than private arrangements, or we risk eventually having a big problem.